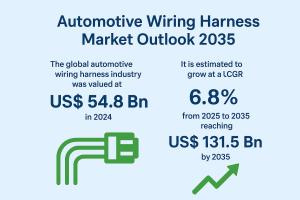

Automotive Wiring Harness Market Valued at US$ 54.8 Bn in 2024, Set to Reach US$ 131.5 Bn by 2035 with 6.8% CAGR | TMR

Automotive Wiring Harness Market Rising Adoption of Advanced Driver-Assistance Systems (ADAS) & Expansion Rapid Electrification of Vehicles Bolstering Market

Automotive Wiring Harness Market Rising Adoption of Advanced Driver-Assistance Systems (ADAS) & Expansion Rapid Electrification of Vehicles Bolstering Market”

WILMINGTON, DE, UNITED STATES, September 25, 2025 /EINPresswire.com/ -- The automotive wiring harness market is a critical backbone of modern vehicle manufacturing, serving as the nervous system that connects electrical components, sensors, and power systems. As vehicles evolve toward greater electrification, autonomy, and connectivity, the demand for sophisticated wiring harnesses has surged. In 2024, the global automotive wiring harness industry was valued at US$ 54.8 billion, reflecting robust recovery from supply chain disruptions post-pandemic. Projections indicate a compound annual growth rate (CAGR) of 6.8% from 2025 to 2035, propelling the market to US$ 131.5 billion by the end of the decade. This growth trajectory is fueled by the rapid shift to electric vehicles (EVs), the integration of advanced driver-assistance systems (ADAS), and stringent global regulations on vehicle safety and emissions.— Transparency Market Research

This comprehensive market research report delves into the automotive wiring harness market outlook through 2035, analyzing key drivers, challenges, segmentation, regional dynamics, and leading players. By examining these elements, stakeholders—ranging from OEMs to suppliers—can navigate opportunities in this high-potential sector. With the automotive industry undergoing a profound transformation, understanding wiring harness trends is essential for strategic decision-making and innovation.

👉 Don’t miss out on the latest market intelligence. Get your sample report copy today @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4179

Market Overview and Size

The automotive wiring harness encompasses bundles of wires, terminals, connectors, and protective sheathing that transmit power and signals across vehicle systems. Historically, the market has mirrored automotive production volumes, but recent years have seen accelerated expansion due to technological advancements. In 2024, the sector's valuation of US$ 54.8 billion underscores its maturity and resilience, particularly in passenger vehicles, which dominate demand.

Forecasts paint an optimistic picture: by 2035, the market is expected to more than double to US$ 131.5 billion, driven by a steady 6.8% CAGR. This projection accounts for rising vehicle electrification, where high-voltage harnesses for batteries and motors become indispensable. Emerging trends like vehicle-to-everything (V2X) communication further amplify the need for lightweight, durable wiring solutions. Overall, the market's evolution from basic electrical routing to smart, integrated systems positions it as a cornerstone of the future mobility ecosystem.

Growth Drivers

Several interconnected factors are propelling the automotive wiring harness market forward. Foremost is the electrification wave: the global push for EVs and hybrid electric vehicles (HEVs) demands advanced harnesses capable of handling higher voltages and thermal stresses. For instance, battery management systems and electric drivetrains require specialized wiring to ensure efficiency and safety, contributing significantly to market expansion. Governments worldwide, through incentives like the U.S. Inflation Reduction Act and EU Green Deal, are accelerating EV adoption, indirectly boosting wiring harness demand.

Another pivotal driver is the proliferation of ADAS and autonomous driving technologies. Features such as lane-keeping assist, adaptive cruise control, and automatic emergency braking rely on seamless data transmission via wiring harnesses connecting cameras, radars, and LIDAR sensors. The integration of these systems in mid-range vehicles is broadening market penetration beyond luxury segments. Regulatory mandates, including the U.S. National Highway Traffic Safety Administration's (NHTSA) guidelines on safety features, further compel manufacturers to invest in robust wiring infrastructure.

Connectivity and infotainment upgrades also play a role. With 5G-enabled vehicles and over-the-air updates becoming standard, harnesses must support high-bandwidth data flows while minimizing electromagnetic interference. Lightweight materials like aluminum and copper alloys are gaining traction to reduce vehicle weight, aligning with fuel efficiency goals. Collectively, these drivers are expected to sustain the 6.8% CAGR, with EVs alone projected to account for a substantial share of incremental growth by 2035.

Challenges and Restraints

Despite promising prospects, the automotive wiring harness market faces notable hurdles. Supply chain vulnerabilities, exacerbated by the 2021-2023 semiconductor shortage, continue to impact production timelines and costs. Delays in chip availability have rippled through harness assembly, particularly for ADAS-equipped models. Additionally, fluctuations in raw material prices—such as copper and PVC—pose cost pressures, prompting suppliers to adopt hedging strategies and alternative sourcing.

Complexity in design for next-gen vehicles adds another layer of challenge. As harnesses integrate more functions, ensuring reliability in harsh environments (vibration, temperature extremes) requires rigorous testing, increasing development expenses. Environmental regulations on halogen-free materials further complicate compliance, though they spur innovation in sustainable alternatives.

Market Segmentation

The automotive wiring harness market is segmented across multiple dimensions, offering granular insights into growth pockets. By component, wires dominate due to their foundational role, followed by connectors and terminals, which are evolving toward miniaturized, high-density designs for space-constrained EVs.

Applications span engine harnesses for power distribution, chassis wiring for structural integrity, body and lighting for aesthetics and safety, and HVAC systems for climate control. Engine and body harnesses lead, but HVAC is poised for faster growth with smart cabin features.

Propulsion type segmentation highlights EVs and HEVs as high-growth areas, contrasting with internal combustion engine (ICE) vehicles, which still hold volume but face decline. Vehicle type-wise, passenger cars command the largest share, driven by consumer demand for connected features, while commercial vehicles grow steadily with fleet electrification. Sales channels primarily flow through OEMs, with aftermarket gaining from retrofits in aging fleets.

Regional Analysis

Asia Pacific reigns supreme in the automotive wiring harness landscape, capturing over 40% market share thanks to manufacturing powerhouses like China, Japan, and India. Low-cost production, government subsidies for EVs, and a burgeoning middle class fuel regional dominance. China alone is a hotspot, with domestic OEMs like BYD scaling up harness needs for export models.

North America follows, buoyed by U.S. EV incentives and Tesla's influence, while Europe emphasizes premium harnesses for luxury brands amid strict emissions norms. Emerging markets in Latin America and the Middle East & Africa offer untapped potential through infrastructure investments.

Key Players

Leading the charge are industry giants like Sumitomo Electric Industries, Ltd., Lear Corporation, and Yazaki Corporation, alongside BorgWarner Inc., Continental AG, and DENSO Corporation. These players focus on R&D for flexible, modular harnesses. Recent moves include BorgWarner's May 2025 contract for hybrid truck eMotors and Furukawa Electric's March 2025 business reorganization to streamline wire production. Strategic alliances, such as Leoni AG's partnerships with EV startups, underscore the competitive edge in innovation.

Borg Warner Inc.

Continental AG

CTS Corporation

DENSO Corporation

Dhoot Transmission

Furakawa Electric Co., Ltd.

Hella GmbH & Co., KGaA

Hitachi Ltd.

Johnson Electric

Lear Corporation

Leoni AG

Sumitomo Electric Industries, Ltd.

Mitusbishi Corporation

NIDEC CORPORATION

Robert Bosch GmbH

Future Outlook

Looking to 2035, the automotive wiring harness market will pivot toward wireless alternatives and AI-optimized designs, reducing wire counts by up to 30%. Sustainability will drive bio-based materials, aligning with circular economy goals.

Conclusion

The automotive wiring harness market's journey to US$ 131.5 billion by 2035 embodies the automotive sector's electrification renaissance. By leveraging drivers like ADAS and EVs while mitigating supply risks, stakeholders can capitalize on this 6.8% CAGR trajectory. As connectivity redefines mobility, agile innovation will define market leaders.

More Related Reports-

• Hydrogen Electrolyzers Market - https://www.transparencymarketresearch.com/hydrogen-electrolyzer-market.html

• HVAC Equipment Market - https://www.transparencymarketresearch.com/hvac-equipment-market.html

• Concrete Placing Booms Market - https://www.transparencymarketresearch.com/concrete-placing-booms-market.html

• Heat Pipe Market - https://www.transparencymarketresearch.com/heat-pipes-market.html

About Us Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. The firm scrutinizes factors shaping the dynamics of demand in various markets. The insights and perspectives on the markets evaluate opportunities in various segments. The opportunities in the segments based on source, application, demographics, sales channel, and end-use are analysed, which will determine growth in the markets over the next decade.

Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision-makers, made possible by experienced teams of Analysts, Researchers, and Consultants. The proprietary data sources and various tools & techniques we use always reflect the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in all of its business reports.

Contact Us

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-345

Atil Chaudhari

Transparency Market Research Inc.

+ +1 518-618-1030

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.