Industrial Disconnect Switch Market to Reach USD 7.66 Billion by 2032

Global Industrial Disconnect Switch Market to Reach USD 7.66 Billion by 2032, Driven by 7.41% CAGR and Strong Asia Pacific Growth

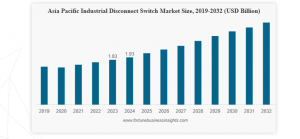

The Asia Pacific dominated the industrial disconnect switch market, accounting for a 40.63% share in 2024.”

PUNE, MAHARASHTRA, INDIA, September 30, 2025 /EINPresswire.com/ -- Market Overview— Fortune Business Insights

The global industrial disconnect switch market was valued at USD 4.75 billion in 2024 and is projected to rise from USD 4.99 billion in 2025 to USD 7.66 billion by 2032, growing at a CAGR of 7.41%. In 2024, the Asia Pacific held the largest market share at 40.63%, supported by rapid industrialization and expanding energy infrastructure.

Disconnect switches play a critical role in industrial safety and electrical reliability, enabling circuit isolation during maintenance or emergency shutdowns. Market growth is underpinned by increasing safety regulations, the modernization of industrial facilities, and investments in power generation and renewable energy.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/113491

Government-backed infrastructure programs are accelerating growth. For example, in March 2025, India pledged USD 600 billion in the power generation sector, emphasizing renewable energy and advanced manufacturing. Meanwhile, leading players such as General Electric (GE), Schneider Electric, and Littelfuse are expanding portfolios to cater to both traditional and renewable applications.

The shift toward solar, wind, and EV charging infrastructure further increases the demand for disconnect switches, particularly for ensuring compliance with safety codes and maintaining electrical stability.

Market Dynamics

Drivers

Industrial modernization & safety compliance: Expanding factories, automation, and stricter regulations are pushing adoption of reliable disconnect solutions.

Rising power sector investments: Global upgrades to transmission and distribution infrastructure are creating consistent demand.

Industrial safety needs: Preventing accidents during maintenance and protecting equipment remain top priorities.

In March 2025, TS Conductor announced a USD 134 million investment in advanced power lines to support AI data centers and manufacturing growth, further fueling market demand.

Restraints

High installation & maintenance costs: Advanced switches involve significant upfront investments, discouraging adoption among SMEs.

Infrastructure challenges in emerging markets: Limited awareness and slow grid modernization restrict faster deployment.

Opportunities

Smart grid integration: IoT-enabled switches offering real-time monitoring and remote control are gaining traction.

Expansion in emerging markets: Rapid industrialization in Asia Pacific and Latin America creates opportunities for localized solutions.

Shift toward renewables: Growing renewable adoption boosts need for reliable switchgear in distributed energy systems.

In October 2024, Schneider Electric introduced a DERMS platform, strengthening grid resiliency and net-zero objectives—showcasing the synergy between smart grids and disconnect solutions.

Have Any Query? Ask Our Experts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/113491

Trends

EV charging growth: Expansion of Level 2 and DC fast charging stations requires compliant disconnect switches for safe circuit isolation.

Renewable infrastructure expansion: Distributed energy systems drive demand for decentralized switchgear solutions.

Segmentation Analysis

By Type

Non-Fused: Expected to dominate due to reliability, versatility, and ease of operation. Popular across manufacturing and utilities for high-load environments.

Fused: Remains essential for applications requiring both isolation and over-current protection, particularly in mining, oil & gas, and heavy machinery.

By Mount

DIN Rail: Leads the market, valued for modularity, compact size, and installation efficiency.

Panel: Significant share, widely used in motor control centers and heavy-duty panels.

Others: Includes specialized configurations tailored to custom industrial applications.

By Voltage

Up to 150 V: Largest segment, fueled by automation and remote monitoring adoption. Common in control circuits, lighting, and low-voltage renewable systems.

150–300 V: Serves mid-range industrial equipment and specialized automation needs.

Above 300 V: Growing segment for medium-to-high power applications, including grid infrastructure and heavy industries.

Regional Insights

North America

Growth supported by aging grid modernization, renewable expansion, and safety codes. The U.S. and Canada are investing heavily in transmission infrastructure. In March 2025, Iberdrola committed USD 20 billion to U.S. power projects, boosting demand for high-capacity disconnect solutions.

Europe

Market expansion driven by renewable transition, industrial automation, and stringent EU safety regulations. Germany, France, and Italy are leading adopters under Industry 4.0, while renewable commitments amplify demand for advanced switchgear.

Asia Pacific

Fastest-growing region due to industrialization in China, India, and Southeast Asia. Massive renewable energy and smart grid investments, coupled with rapid urbanization, position Asia Pacific as the global hub for disconnect switch demand.

Latin America

Emerging opportunities in Brazil, Mexico, Argentina, and Chile where modernization of industrial sectors and renewable adoption is accelerating. Automotive, mining, and food processing industries are particularly driving adoption.

Middle East & Africa

Growth supported by mega-projects like NEOM (Saudi Arabia) and Lusail City (Qatar), where infrastructure requires reliable low-to-medium voltage disconnect switches. Rising urbanization and energy diversification efforts contribute significantly.

Inquire Before Buying This Research Report: https://www.fortunebusinessinsights.com/enquiry/queries/113491

Competitive Landscape

The market is fragmented with global and regional players focusing on product diversification and smart solutions. Leading companies include:

General Electric (U.S.)

Littelfuse Inc. (U.S.)

Schneider Electric SE (France)

Havells India Ltd (India)

Siemens AG (Germany)

Eaton Corporation (Ireland)

ABB (Switzerland)

Honeywell (U.S.)

Recent Developments

Dec 2023: Mennekes launched new industrial motor disconnect switches for wash-down environments.

Oct 2023: Littelfuse introduced Class J Fuse Disconnect Switch combining fuse protection with circuit isolation.

Jun 2023: RS Group expanded its Altech disconnect switch lineup.

Jul 2023: Eaton secured EV battery disconnect unit contracts with integrated Breaktor technology.

Report Coverage

This study covers 2019–2032 with 2024 as the base year and 2025 as the estimate year. It provides:

Market size & forecasts across segments.

Regional and country-level analysis.

Competitive landscape and strategic developments.

Insights on regulatory standards, safety codes, and renewable adoption trends.

Key Takeaways

Market size: USD 4.75 billion (2024) → USD 7.66 billion (2032).

Growth rate: 7.41% CAGR (2025–2032).

Top segment: Non-fused disconnect switches.

Largest region: Asia Pacific (40.63% share in 2024).

Key driver: Industrial modernization & renewable energy investments.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/113491

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.