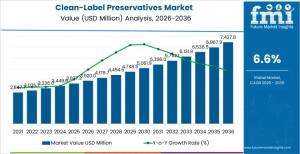

Clean-Label Preservatives Market to Reach USD 7,427.8 Million as Food Makers Shift from Synthetic Additives

Clean-label preservatives gain traction as food makers replace synthetic additives with natural systems tailored for safety, shelf life, & regulatory compliance

NEWARK, DE, UNITED STATES, January 19, 2026 /EINPresswire.com/ -- The global clean-label preservatives market is entering a sustained growth phase as food manufacturers reformulate products to replace conventional synthetic preservatives with label-friendly alternatives. The market is expected to expand steadily through 2036, supported by rising demand for preservation systems that balance microbial safety, shelf-life stability, and simplified ingredient declarations across packaged food categories.

Clean-label preservatives are increasingly adopted across bakery, dairy alternatives, ready meals, beverages, and processed foods, where retailers and regulators impose stricter formulation constraints. Organic acids, fermentation-derived systems, and cultured ingredients are gaining specification preference as they deliver effective spoilage control while aligning with clean-label positioning. Growth is driven less by broad transparency trends and more by application-specific performance requirements tied to moisture content, pH range, and processing conditions.

Explore trends before investing – request a sample report today! https://www.futuremarketinsights.com/reports/sample/rep-gb-31468

Market Context: Why Clean-Label Preservation Is Reshaping Formulation Strategies

Food manufacturers are prioritizing clean-label preservatives as resistance to traditional synthetic additives intensifies among consumers and retail buyers. In ready-to-eat meals, deli salads, baked goods, and packaged snacks, long ingredient lists are increasingly associated with lower perceived quality. Clean-label systems based on fermented derivatives, plant extracts, and cultured ingredients allow manufacturers to extend shelf life without triggering negative label perception.

Adoption is strongest in product categories with elevated spoilage risk. Bakery producers use organic acids and fermented solutions to replace propionates while maintaining mold inhibition. Dairy alternatives and chilled meals rely on fermentation-derived preservatives that remain effective under refrigeration without altering taste or aroma. Beverage manufacturers apply mild acid systems and botanical antimicrobials where clarity and flavor stability allow. These dynamics reinforce matrix-specific preservative selection rather than cross-category substitution.

Segmentation Highlights: Preservative Type, Form, and Application

Demand for clean-label preservatives varies by formulation need, processing exposure, and storage condition.

By preservative type, organic acids and salts hold the largest demand share at 34.0%, supported by broad antimicrobial activity and established regulatory acceptance. Fermentation-derived preservatives account for 26.0%, reflecting their natural positioning and performance consistency. Plant extracts and botanicals represent 21.0%, primarily where label perception and multifunctionality are critical. Cultured sugar and vinegar systems contribute 13.0%, while niche solutions make up the remaining share.

By form, powders dominate usage at 54.0% due to storage stability and dosing precision. Liquid systems represent 38.0%, favored in wet processing environments for uniform dispersion. Encapsulated preservatives account for 8.0%, applied where controlled release or sensory masking is required.

By application, bakery and confectionery lead demand with 29.0%, followed by dairy and dairy alternatives at 23.0%. Processed and ready meals account for 20%, meat and plant-based meat alternatives for 16%, and beverages for 12%. Each segment applies preservation systems tailored to specific microbial and sensory challenges.

Key Market Dynamics Shaping Adoption

Growth in the clean-label preservatives market is driven by the need to manage spoilage risk without compromising ingredient transparency. Manufacturers evaluate preservatives based on antimicrobial spectrum, pH effectiveness, thermal stability, and sensory impact rather than label appeal alone. In chilled meals and fresh juices, systems must remain effective under refrigeration and across variable pH conditions. Bakery formulations require mold inhibition without affecting crumb structure or flavor.

Scalability remains influenced by functional limitations of certain natural extracts, regional labeling rules, and cost considerations when multi-component systems are required. Sensory validation and shelf-life testing extend development timelines, shaping the pace and scope of adoption across complex product portfolios.

Global Outlook: Regional Demand Trends

Global demand for clean-label preservatives is expanding as manufacturers replace synthetic systems to meet regulatory scrutiny and retailer mandates. Growth is strongest in markets where reformulation pressure is highest rather than where packaged food volumes are rising fastest.

India leads growth with a 7.9% CAGR, driven by high ambient temperatures, expanding packaged food consumption, and organized retail growth. China follows at 7.6%, supported by large-scale industrial reformulation and demand for preservatives compatible with ultra-high-temperature processing. Brazil records 7.2% growth, reflecting tropical spoilage challenges and nutrition labeling reforms. The USA and UK grow at 5.8% and 5.6% respectively, driven by retailer-led clean-label standards and portfolio-wide ingredient simplification.

Competitive Landscape and Industry Positioning

Competition in the clean-label preservatives market centers on antimicrobial efficacy, sensory neutrality, regulatory clarity, and technical support. Buyers prioritize suppliers capable of supporting reformulation through microbiology expertise and application testing.

Kerry Group, Corbion, DSM-Firmenich, Kemin Industries, and DuPont (IFF) remain prominent in global demand. These companies differentiate through fermented, organic acid, and nature-derived systems tailored to bakery, dairy, meat, and beverage applications. Competitive advantage increasingly depends on the ability to deliver consistent shelf-life performance while supporting clean-label compliance across regions.

Key Players in the Clean-Label Preservatives Market

• Kerry Group

• Corbion

• DSM-Firmenich

• Kemin Industries

• DuPont (IFF)

• Others

Browse Related Insights

Food Preservatives Market: https://www.futuremarketinsights.com/reports/global-food-preservatives-market

Green Preservatives Market: https://www.futuremarketinsights.com/reports/green-preservatives-market

Bread Preservatives Market: https://www.futuremarketinsights.com/reports/bread-preservatives-market

Natural Food Preservatives Market https://www.futuremarketinsights.com/reports/natural-food-preservatives-market

Sudip Saha

Future Market Insights Inc.

+18455795705 ext.

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.